United States v. Butler - taxes

01/06/1936 AD decided

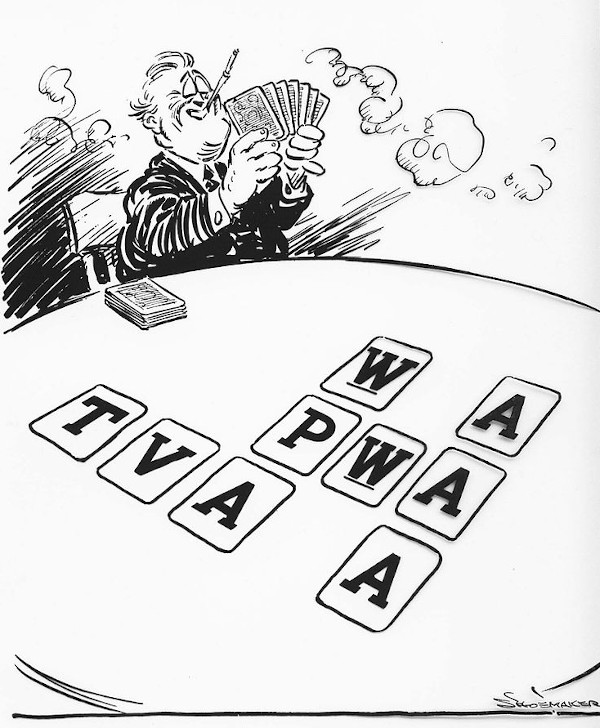

The main issue of the case was whether certain provisions of the Agricultural Adjustment Act of 1933 conflicted with the U.S. Constitution. The Act imposed a tax on processors of farm products, the proceeds of which to be paid to farmers who would reduce their area under cultivation and consequently their crops yields. The Act was intended was to increase the prices of certain farm products by decreasing the supply of quantities produced.

The Court held that the so-called tax was not a true tax since the payments to farmers were coupled with unlawful and oppressively-coercive contracts, and the proceeds were earmarked for the benefit of farmers complying with the prescribed conditions. The Court also held that making the payment of a government subsidy to a farmer conditional on the reduction of the planned crops went beyond the powers of the national government.

The Court struck down the Act but dealt positively with taxation and the expenditure of funds to advance the general welfare as specified in Article 1, Section 8, of the Constitution. The Court stated that the issue "presents the great and the controlling question in the case."

Lattitude: 38.9072° N

Longitude: 77.0369° W

Region: North America

Modern Day United States

Subjects Who or What decided?

-

Supreme Court of the United States The highest court in the...

Objects To Whom or What was decided?

-

Agricultural Adjustment Administration (AAA) An agency of the U.S. De...

Timelines (that include this event)

Events in 1936 MORE