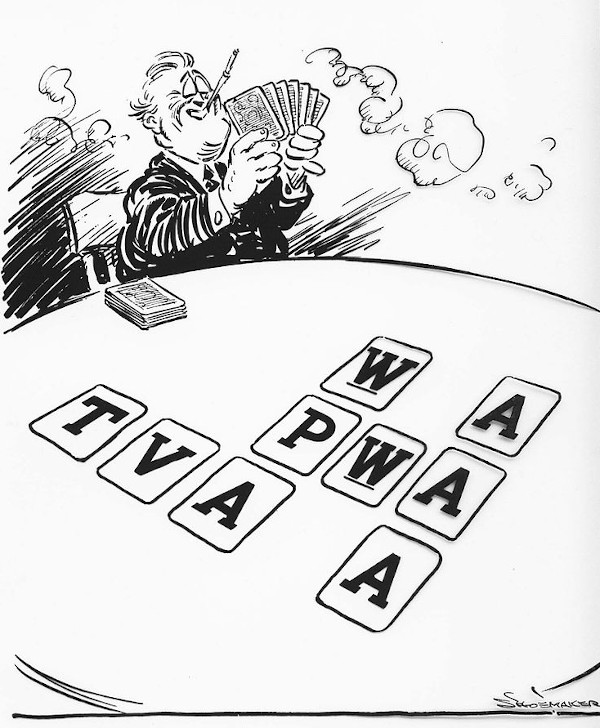

Securities Act of 1933

05/27/1933 AD enacted

Requires every offer or sale of securities that uses the means and instrumentalities of interstate commerce to be registered with the SEC pursuant to the 1933 Act, unless an exemption from registration exists under the law.

The term "means and instrumentalities of interstate commerce" is extremely broad and it is virtually impossible to avoid the operation of the statute by attempting to offer or sell a security without using an "instrumentality" of interstate commerce. Any use of a telephone, for example, or the mails would probably be enough to subject the transaction to the statute.

Before the Wall Street Crash of 1929, securities were unregulated at the federal level. Even firms whose securities were publicly traded published no regular reports or even worse rather misleading reports based on arbitrarily selected data. To avoid another Wall Street Crash, the Securities Act of 1933 was enacted. It required the disclosure of the balance sheet, profit and loss statement, and the names and compensations of corporate officers for firms whose securities were traded. Additionally, the reports had to be verified by independent auditors.

Lattitude: 38.9072° N

Longitude: 77.0369° W

Region: North America

Modern Day United States

Subjects Who or What enacted?

-

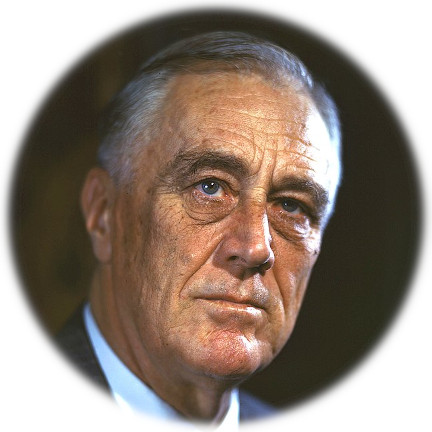

Franklin Delano Roosevelt (FDR) 32nd President of ...

Timelines (that include this event)

Events in 1933 MORE